-

Diamondback Energy, Inc. Announces Midland Basin Acquisition

Source: Nasdaq GlobeNewswire / 11 Oct 2022 16:01:00 America/New_York

MIDLAND, Texas, Oct. 11, 2022 (GLOBE NEWSWIRE) -- Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback” or “the Company”) today announced that it has entered into a definitive purchase agreement to acquire all leasehold interest and related assets of FireBird Energy LLC (“FireBird”) in exchange for 5.86 million shares of Diamondback common stock and $775 million of cash. The cash portion of this transaction is expected to be funded through a combination of cash on hand, borrowings under the Company’s credit facility and/or proceeds from a senior notes offering. The cash outlay at closing is expected to be approximately $700 million due to the expected Free Cash Flow to be generated on the asset between the effective date and expected closing date late in the fourth quarter of 2022.

“This bolt-on acquisition adds significant, high-quality inventory right in our backyard,” stated Travis Stice, Chairman and Chief Executive Officer of Diamondback. “With over 350 locations adjacent to our current Midland Basin position, this asset adds more than a decade of inventory at our anticipated development pace, including inventory that competes for capital right away in Diamondback’s current development plan. Also, importantly, this transaction is accretive on all relevant 2023 and 2024 financial metrics, immediately increasing expected per share returns to our stockholders in the near-term while also improving the long-term duration of the Company’s cash return profile.”

Mr. Stice continued, “We remain committed to capital discipline by returning at least 75% of our Free Cash Flow to stockholders while also maintaining a fortress balance sheet. To do this, we are today announcing a target to sell at least $500 million of non-core assets by year-end 2023, with proceeds earmarked for further debt reduction.”

Transaction Highlights

- Valued at approximately 3x 2023 EBITDA with a 15% Free Cash Flow Yield at strip pricing

- Immediately accretive to all relevant 2023 and 2024 financial metrics including Cash Flow per share, Free Cash Flow per share and NAV per share

- Increases expected pro forma 2023 per share cash returned to stockholders by approximately 3%

- Extends pro forma inventory life in primary development zones

- Leverage neutral

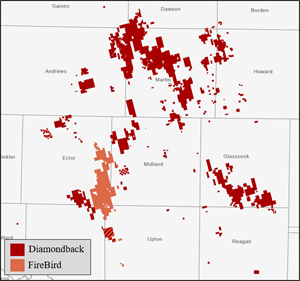

Asset Highlights: Building Scale in the Midland Basin

- Approximately 75,000 gross (68,000 net) highly contiguous acres in the Midland Basin

- Estimated production at closing of approximately 17 MBo/d (22 MBoe/d)

- 2023 estimated average production of approximately 19 MBo/d (25 MBoe/d)

- 2023 oil production can be maintained for multiple years with one rig running; Diamondback expects to reduce operated rig count from three currently to one post-closing for 2023 development

- 353 estimated gross (316 net) horizontal locations in primary development targets with an average lateral length of approximately 11,400’; 84 gross upside locations from co-development based on recent well results

- Primary targets are the Middle Spraberry, Lower Spraberry, Wolfcamp A and Wolfcamp B formations

- 98.5% of acreage is operated with an average 92% working interest; 84% of acreage currently held by production

Diamondback expects this transaction to close late in Q4 2022.

Advisors:

Kirkland & Ellis LLP is serving as legal advisor to Diamondback and Akin Gump Strauss Hauer & Feld LLP and Weil, Gotshal & Manges LLP are serving as legal advisors to FireBird and its affiliates. RBC Capital Markets and Goldman Sachs & Co. LLC are serving as lead financial advisors to FireBird.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural gas company headquartered in Midland, Texas focused on the acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. For more information, please visit www.diamondbackenergy.com.

Forward Looking Statements

The foregoing release contains forward-looking statements as defined by the Securities and Exchange Commission. All statements, other than statements of historical fact, including statements regarding future financial performance; business strategy; future operations (including production; drilling plans; capital plans; and upside locations); projections of revenues, losses, costs, expenses, returns, cash flow, financial position and reserves; anticipated benefits and risks of the potential acquisition (including EBITDA contribution, accretion and free cash flow yield); the timing of the potential acquisition; and plans and objectives of management (including plans for future cash flow from operations and capital returns) are forward-looking statements. The words “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “model,” “outlook,” “plan,” “positioned,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions (including the negative of such terms) are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. The forward-looking statements are based on management’s current beliefs, based on currently available information, as to the outcome and timing of future events, including the current industry and macroeconomic conditions, commodity pricing environment, production levels, any future regulatory actions affecting Diamondback, the impact and duration of the COVID-19 pandemic, acquisitions and sales of assets, drilling and capital expenditure plans, environmental targets and initiatives and other factors believed to be appropriate. Forward looking statements are not guarantees of performance. These forward-looking statements involve certain risks and uncertainties, many of which are beyond Diamondback’s control and could cause the actual results or developments to differ materially from those currently anticipated by the management of Diamondback. These risks include, but are not limited to, the delay or failure to consummate the transaction due to unsatisfied closing conditions or otherwise; the risk that the acquired assets do not perform consistent with our expectations, including with respect to future production or drilling inventory; and those other risks identified in Diamondback’s filings with the Securities and Exchange Commission, including its reports on Forms 10-K, 10-Q and 8-K. Diamondback undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise.

Investor Contact:

Adam Lawlis

+1 432.221.7467

alawlis@diamondbackenergy.comA photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/aec89f4e-42fe-467b-89ec-46168cb8178a